Living a Tax Free Life

Now for only 2 days

Invest in Yourself and Learn How to Live Better by Paying Less Tax.

January 27th and 28th

12pm and 6pm

Limited Seating Available!

Are You Ready To

Choose Your Future?

Live the life you've always dreamed of.

OR

Stay at home and do nothing.

Most people don’t realize what they’re missing—until it’s too late.

Most people believe they’re “doing the right things.”

They’re saving.

They’re invested.

They’re working with an advisor or a CPA.

And yet, what they don’t realize is that important decisions are often being made by default—not by design.

Hurry - this is a limited time offer with powerful information to change your life!

Ready to Learn Advanced Tax Strategies?

Are you exploring ways to gain a deeper understanding of advanced tax planning strategies? Our educational seminar provides a new perspective on sophisticated approaches to tax efficiency.

Would it be worth a couple of hours to potentially save you thousands and in some cases hundreds of thousands and even millions of dollars in tax?

Join us to explore these common tax planning considerations:

Understanding the complexities of tax regulations and their impact on your planning.

Exploring potential tax-efficient methods and overlooked planning considerations.

Learning about advanced strategies to improve your overall tax planning approach.

Gaining new insights into tax planning to prepare for future financial decisions.

The Benefit-Oriented, Compliant Approach

Our event provides a structured framework for understanding advanced tax strategies. Through our educational content, you'll gain valuable insights into Roth conversions, tax planning for high-net-worth individuals, and other professional-level techniques. This seminar is ideal for anyone interested in a deeper dive into tax-efficient planning.

Exploring Advanced Tax Strategies

Learn about sophisticated tax planning techniques and considerations.

Roth Conversion Methods

Gain a deeper understanding of various Roth conversion strategies and how they fit into a comprehensive plan.

Insights into Financial Planning

Discover how tax-efficient strategies can integrate with and enhance your overall financial planning.

Tax Planning Oversight Discussions

Identify common tax planning oversights and learn what questions to discuss with your tax and financial advisors.

Long-Term Strategic Planning

Explore techniques for year-round tax-efficient planning and preparing for future financial decisons.

Holistic Tax Education

Understand how various tax strategies can be integrated into a single, comprehensive knowledge base.

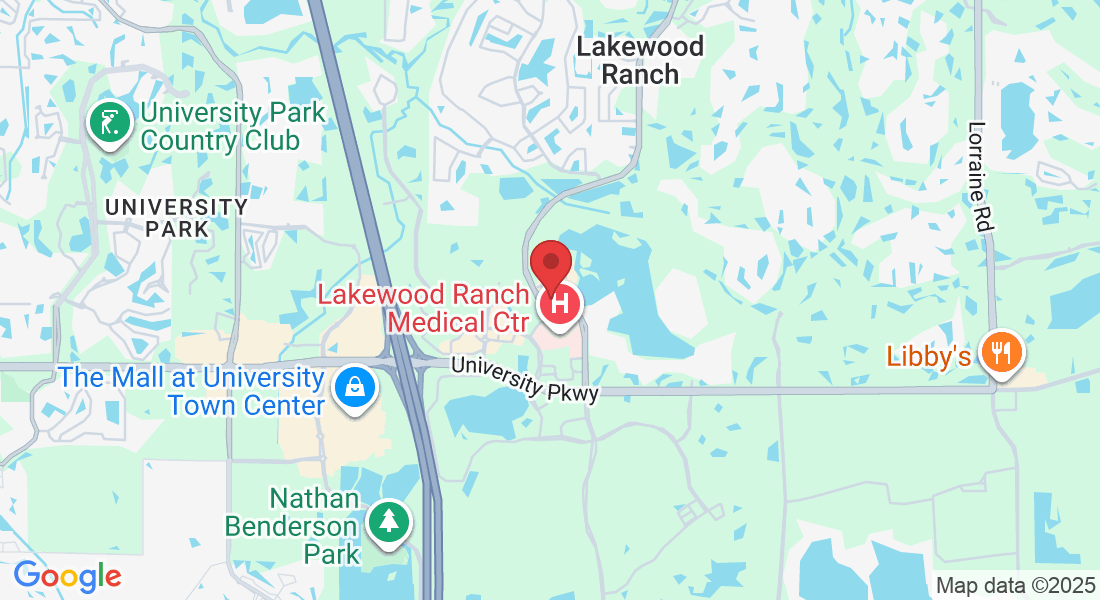

Event Details - Lakewood Ranch, Florida

If you are unable to attend but would still like to learn more about our AI Tax Software book a call with us.

LIMITED TIME OFFER

Attend Our Living a Tax Free Life Seminar

What is included

Advanced Tax Planning Strategies & Techniques

Comprehensive Tax Planning Considerations

Strategies for Proactive Tax Planning

Understanding the Role of Tax Reviews

Tax-Efficient Business Planning Approaches

Insights from Experienced Professionals

What You'll Learn

Our seminar provides a framework for understanding complex tax planning. we'll explore strategies, analysis, and key considerations.

DISCOVER THE DIFFERENCE

The Old Way vs. The [Your Solution

/Service] Way

Traditional methods of tax filing and management often lead to confusion, missed deductions, and compliance issues.

With [Your Service], we’ve streamlined the process to make it efficient, effective, and stress-free.

Manual Tax Filing

Efficient, Digital Tax Filing

Lack of Tax Planning

Proactive Tax Planning

Inconsistent Records

Organized, Streamlined Records

Struggling with Complex Tax Laws

Clear, Expert Tax Advice

Last-Minute Filing

Early Tax Filing

ABOUT US

One Wealth Map, LLC

As an SEC-Registered Investment Advisor, One Wealth Map, LLC is dedicated to providing clients with comprehensive financial insights and objective guidance. Our educational seminar, "Living a Tax Free Life," draws on our expertise in holistic financial analysis, wealth management, and retirement strategies to provide attendees with a deeper understanding of tax-efficient planning. We believe empowering individuals with knowledge is the first step toward making informed financial decisions.

Objective Fiduciary Guidance

Comprehensive Planning Expertise

Informed by Decades of Experience

No part of this event shall be considered, legal, investment tax or asset protection advice. Before any individual tax advice is rendered we must have a complete understanding of your current tax siutation, and only then do we utilize the AI Tax Planner to derive individual solutions. All tax advice, tax planning and tax preparation are done through H&H Tax and Business Advisors, LLC. One Wealth Map, LLC is a SEC Registered Investment Advisory and you can access our ADV Part II and CRS through sec.gov. No part of this presenation will cover investments or any type of investment advise. This event is soley on tax and tax strategies